Customer Compliance Portal

Manage Organization-Wide PCI DSS Compliance Status with One Easy‑to‑Use Tool

Track and Manage Your PCI DSS Compliance Needs

CampusGuard Central® 2.0, CampusGuard’s dynamic customer compliance portal, is designed specifically for campus and community-based organizations and gives you the tools you need to assess, track, and document your PCI DSS compliance across multiple campuses, divisions, and departments.

Why Choose CampusGuard Central for Your PCI DSS Compliance Portal Needs?

Maintaining the highest level of data security is at the core of the PCI DSS. Simplifying the method by which you manage your compliance status with the PCI DSS will empower your organization to strategize and prioritize your next steps to achieve and sustain compliance.

Benefits of a Customer Compliance Portal

CampusGuard’s Customer Compliance Portal was specifically designed to serve complex organizations. The highly customizable dashboard gives you an at-a-glance view of PCI DSS Compliance across your entire enterprise. Here are its key features and functionality:

-

Customizable users and groups

Add users based on roles and configurable by campus, department, or other organizational structure. Easily group merchants by department. -

All-in-one dashboard

Seamlessly integrate scanning requests, tracking, and reporting. Easily monitor status and activity via the customized, role-based dashboard. -

Unique access

Each merchant is granted a unique login to view their specific SAQ’s only (Many:One), administrators are provided with unique access to view all merchant information (One:Many) -

Self-assessment questionnaires

Create a summarized SAQ (by bank/processor, department, and SAQ type), and more. Directly assign SAQs to merchants to avoid confusing questions that might land a merchant in the wrong SAQ for their environment. -

Empower your Merchants

Allowing merchants to complete individual SAQs for each of their payment processes helps make them more accountable for compliance and empowers them to make educated decisions to address ongoing risk. -

Real-time reporting

Generate an up-to-date Merchant Inventory report based on real-time data. Export robust reports in various formats (XLS, CSV, PDF, JSON). -

Resource library

Access to CampusGuard's full library of templates, checklists, procedural guides, and more. -

Expert Support

Direct access to the credentialed QSA and PCIP staff at CampusGuard allows merchants in CampusGuard Central to ask questions and receive timely support from staff members that live and breathe PCI.

Simplify Your Organization's Compliance Management

Monitoring organization-wide PCI DSS Compliance has never been easier. Our portal is designed to give you an overview of your entire enterprise so you can easily identify and rectify areas that can be impeding your compliance status, keeping your information more secure and your organization more protected from vulnerabilities.

Top Compliance Portal Assessment FAQs

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards created to protect against fraud and ensure the security of credit card transactions. PCI DSS provides guidelines for merchants, financial institutions, and other organizations that handle credit card data to establish and maintain secure systems and procedures for storing, processing, and transmitting cardholder data. Compliance with PCI DSS is mandatory for any organization that accepts credit card payments, and failure to comply can result in penalties, fines, and loss of business.

Any organization that accepts credit card payments or processes, stores, or transmits credit card data is required to comply with the PCI DSS standards. This includes merchants, service providers, financial institutions, and other organizations that handle credit card data.

Compliance with PCI DSS is mandatory for all organizations that accept credit card payments, regardless of their size or the number of transactions they process. However, the specific requirements for compliance may vary depending on the size and complexity of the organization's operations and the volume of credit card transactions it handles.

PCI DSS requirements include:

- Install and maintain a firewall

- Change vendor-supplied default passwords and security settings

- Protect stored cardholder data

- Encrypt cardholder data when transmitting it across open, public networks

- Use and regularly update antivirus software

- Develop security systems and processes

- Restrict access to cardholder data to a need-to-know basis

- Assign user IDs to everybody with computer access

- Restrict physical access to cardholder data

- Track and monitor who accesses networks and cardholder data

- Regularly test systems and processes

- Have a policy on information security

Once you determine your organization's compliance level, you will either fill out a Self-Assessment Questionnaire and a subsequent Attestation of Compliance, or you will need a PCI QSA to fill out a Report on Compliance.

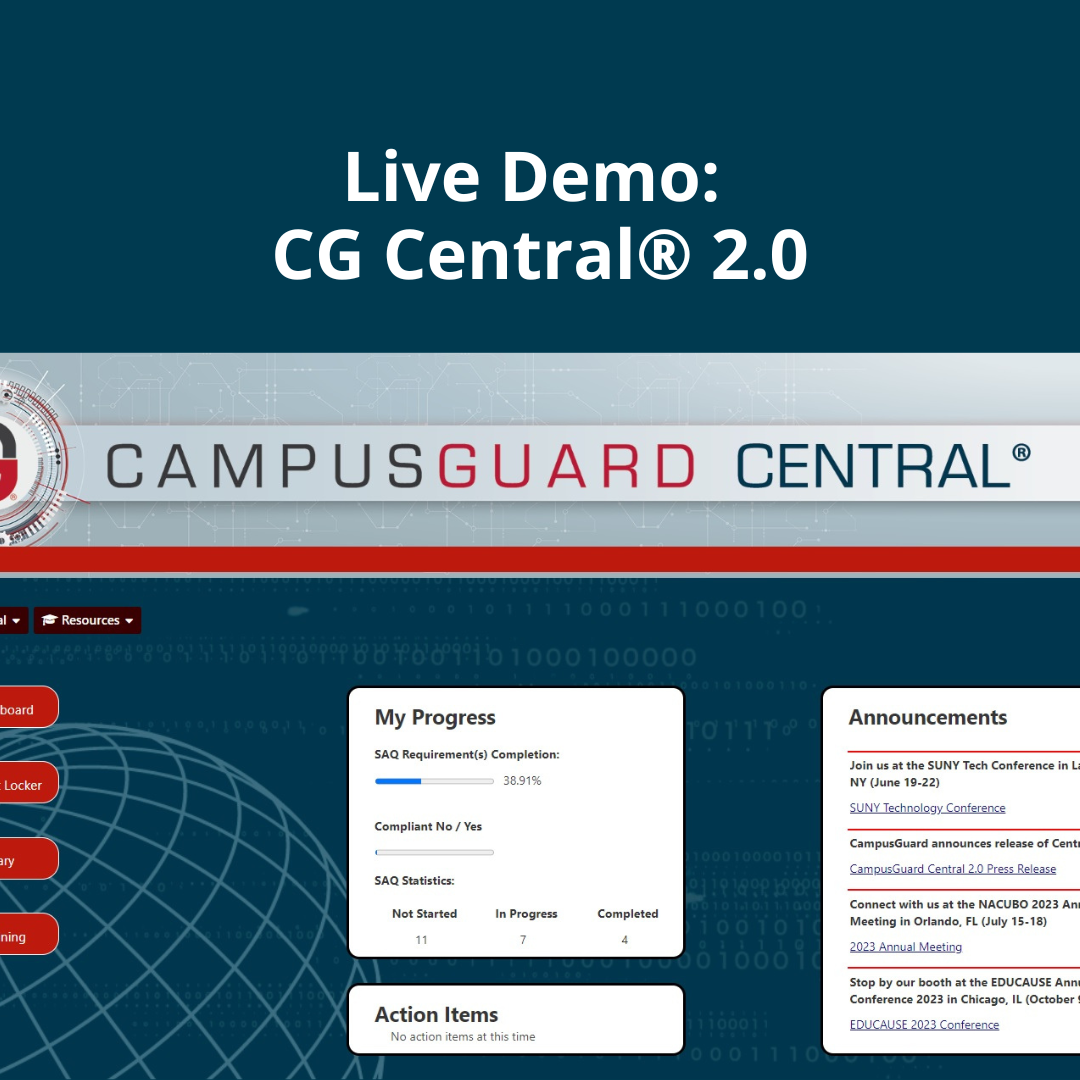

CG Central® 2.0 Demo Day

Get an inside look at CampusGuard Central® 2.0, our compliance management portal that includes the tools you need to assess, track, and document your PCI DSS compliance across multiple organizations, campuses, and departments.

Watch Now about the CG Central® 2.0 Demo Day